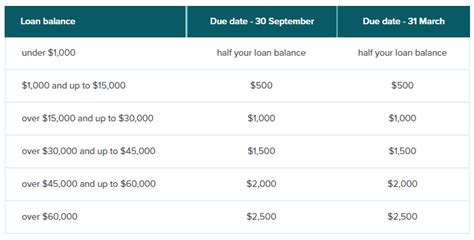

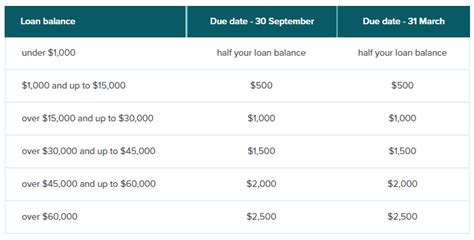

nz student loan overseas repayment|nz student loan forgiveness : 2024-10-08 Your repayments are based on your total loan balance on 31 March each year you are overseas-based. There are 2 things to keep in mind with overseas-based repayments. 1. Your minimum repayments may go up if your loan balance increases and moves into the next repayment bracket. This may be due to . See more Alle Groene Adidas 8K 2020 sneakers Vergelijk alle aanbiedingen en SALE items uit november Bekijk alle prijzen bij de verschillende winkels!

0 · student loan repayments when overseas

1 · student loan repayment threshold nz

2 · student loan payments nz

3 · student loan calculator nz

4 · nz student loan repayment rate

5 · nz student loan repayment calculator

6 · nz student loan forgiveness

7 · how to pay off debt from overseas

Ontdek de stijlvolle en sportieve trainingspakken en joggingpakken van adidas voor dames, heren en kinderen. Shop het uitgebreide assortiment nu online.

nz student loan overseas repayment*******Your repayments are based on your total loan balance on 31 March each year you are overseas-based. There are 2 things to keep in mind with overseas-based repayments. 1. Your minimum repayments may go up if your loan balance increases and moves into the next repayment bracket. This may be due to . See moreThe amount you initially need to pay by each due date depends on your loan balance when you first become overseas-based, which is the day after you leave New . See more

Use our student loan repayment calculator if you want to see how long it'll take to pay off your loan. You can compare how long it'll take to pay off making the . See more

Becoming overseas-based depends on how long you're away for. If you're away for: more than 184 days, you'll become overseas-based. If you become overseas-based, your .If you're about to move overseas, or have recently left, you can take up to a 12 month break from repaying your student loan. Temporary repayment suspension for student loans. You can apply to negotiate your repayments if you need to make them more affordable for a while. Send a student loan overseas-based customer repayment application - IR219

Becoming overseas-based depends on how long you're away for. If you're away for: more than 184 days, you'll become overseas-based. If you become overseas-based, your student loan will no longer be interest-free from the day after you left New Zealand. If you leave New Zealand for more than 325 days, you may also become a non-resident .The Student Loan is interest free if you stay in New Zealand. If you don’t make your payments on time, you may be charged late payment interest. If you go overseas, you may be charged interest. It depends how long you go for. Student Loan interest and fees - Inland Revenue.This is only charged on the overdue amount, and only if the overdue amount is $334 or more. It will keep being charged until you have caught up with your payments. The late payment interest rate is currently 7.3%. This is calculated as a monthly rate of 0.588%. The standard interest rate applies to the rest of your loan.

Overdue student loan repayments have ballooned in New Zealand as Kiwis dodge their debts by decamping overseas. Total overdue debt rose by NZ$188 million (£90 million) to more than NZ$2.2 billion in 2022-23, according to the student loan scheme’s latest annual report, with more than 90 per cent of the increase attributed to . If you go overseas, you might be charged interest on your student loan. If you will be living in Niue, the Cook Islands, Tokelau or the Ross Dependency, you may be able to keep your student loan interest-free. Learn more about what to expect if you will be living in one of the above locations, on the Inland Revenue website. If you will be .

0808 234 0098. Call wait times unavailable. Overseas-based customers - calling from the rest of the world*. +64 4 832 5242. Call wait times unavailable. Additional countries can now call us for free from Australia, Canada, United States of America, China, Hong Kong Special Administrative Region, South Korea and United Kingdom: Overseas . If you miss a repayment due date, late payment interest will be applied to the overdue amount at a rate of 6.8% (made up of 2.8% base interest and 4% penalty interest). In some cases, you may be .By the payment due date. You can make payments to us with Visa and Mastercard credit and debit cards from overseas. You’ll need to check with your bank or provider to make sure you are clear about international fees. Also, banks often charge a convenience fee of 1.42% for credit and debit card payments. From 28 October 2021 the convenience .

PO Box 39050. Wellington Mail Centre. Lower Hutt 5045. New Zealand. Last updated: 23 May 2024. Everything you need to complete the IR219 form, a link to the form and what to do next.Student loan repayments for your main job. You repay 12% of every dollar you earn over the pay period repayment threshold when you use a tax code with 'SL' for your main job (M SL or ME SL). For example, in the 2025 tax year, if you earn $600 a week before tax, your repayment will be $16.32. $600 (weekly pay before tax) − $464 (weekly .

Find out more about student loan repayments if working in New Zealand for salary or wages. 2 Student loan repayments from other income. . Unless you are on a repayment holiday, you need to make student loan repayments while overseas. These are based on your total loan balance and are generally due in two equal instalments on 30 September .Going overseas. If you're going overseas, your payment may be affected. It depends what payment you're getting and why you're going overseas. You need to let us know straight away if you're going overseas. We compare records with New Zealand Customs so we'll know if you go overseas. If you don't tell us, you may have a debt to pay back.If you live overseas and decide to study a course through distance learning that's based in New Zealand, you may be able to get a Student Loan and Student Allowance. You need to be: a New Zealand citizen; studying a course that's run by a New Zealand education provider. You also need to meet the criteria for Student Loan and Student Allowance

Student loan repayments for your main job. You repay 12% of every dollar you earn over the pay period repayment threshold when you use a tax code with 'SL' for your main job (M SL or ME SL). For example, in the 2025 tax year, if you earn $600 a week before tax, your repayment will be $16.32. $600 (weekly pay before tax) − $464 (weekly .

Find out more about student loan repayments if working in New Zealand for salary or wages. 2 Student loan repayments from other income. . Unless you are on a repayment holiday, you need to make student .Going overseas. If you're going overseas, your payment may be affected. It depends what payment you're getting and why you're going overseas. You need to let us know straight away if you're going overseas. We compare records with New Zealand Customs so we'll know if you go overseas. If you don't tell us, you may have a debt to pay back.

If you live overseas and decide to study a course through distance learning that's based in New Zealand, you may be able to get a Student Loan and Student Allowance. You need to be: a New Zealand citizen; studying a course that's run by a New Zealand education provider. You also need to meet the criteria for Student Loan and Student Allowance

Repayment of student loans taken in New Zealand is required as soon as the income threshold of $22,828 (2024 tax year) . On 22 March 2007, the Government introduced a three-year 'loan repayment holiday' for those overseas. In practice, this is a uniform extension of the previous ability to waive repayments until a later date. As before .Your student loan may stay interest-free when you're overseas-based if the main reason you go overseas is because you: had an unexpected delay when you were returning to New Zealand. were unexpectedly required to travel after you’ve returned to New Zealand. are studying overseas. are volunteering overseas.nz student loan overseas repayment nz student loan forgivenessOnline money transfer. Online by debit card or credit card. Payments made on your behalf. Australian payment options. Your debt with us. If you owe us money, we want to help you repay it in a way that best suits your situation. We have a range of overseas repayment options available if you're not getting a Student Allowance from us.Section 107B (3) prescribes when the borrower has reached their repayment holiday limit as follows: The borrower has had a repayment holiday of one year (365 days). The borrower has had a three-year repayment holiday under the Student Loan Scheme Act 1992. The borrower has had a repayment holiday for less than three years under the . Budget 2013 will target overseas-based student loan borrowers with new initiatives to increase repayments and reduce defaulting, Tertiary Education, Skills and Employment Minister Steven Joyce and Revenue Minister Peter Dunne say. “Overseas-based borrowers are continuing to let the side down with slow repayments and high .If you can get Fees Free study, you may not need a Student Loan for your course fees. However, you'll still need to apply for a Student Loan if you want course-related costs or living costs. A Student Loan helps to pay for your course fees, study materials (e.g. books or a computer) and weekly living costs.nz student loan overseas repaymentHer last repayment was made on 31 March 2010. Her loan balance on that date is $8,300. Tracey's repayment obligation for the following tax year is $1,000. Tracey subsequently returns to New Zealand and becomes a New Zealand-based borrower. Eighteen months after returning, Tracey goes overseas again and becomes an overseas-based borrower.nz student loan forgiveness The biggest hack you probably don’t know about your student loans is something called the Foreign Earned Income Tax Exclusion. You can exclude over $100,000 of income earned abroad from your tax return as a U.S. citizen. For 2023, you can exclude up to $120,000. This amount is adjusted annually for inflation.

Adidas hoofdbeschermers zijn ontworpen voor taekwondo beoefenaars van alle niveaus, van kinderen en beginners tot wedstrijdsporters. Met geavanceerde technologie en .

nz student loan overseas repayment|nz student loan forgiveness